China HS code system VS Harmonized System Code

YQN Operation Team | 2024.12.13 | info@yqn.com

What is Harmonized System Code

Harmonized System (HS) codes, serve as a universal language for classifying goods created by World Customs Organization. They play an important role in customs compliance, tariff determination, and supply chain management.

Understanding China HS code variations is crucial for importing and exporting, particularly when calculating the tariffs and duties.

Difference of HS code China

The Harmonized Commodity Description and Coding System usually uses 6 digits to create a standardized method for classifying different goods. However, many countries add 2 or 3 digits to apply specific tariff rates and import duties tailored to their customs’ policies.

For example, Chinese HS code usually concludes 10 digits, the first 6 digits are main codes corresponding to the standard HS code, the 7th and 8th digits are national subheadings established for the purposes of tariff, trade statistics or trade policy measures, and the 9th and 10th digits are often utilized for customs declaration data or refined data.

The 10-digit HS code in China usually is for customs declaration and conclude more detailed classification of goods to meet China customs requirements, such as the incoterms, the information of consignee, the customs declaration unit, the transportation method, and the unit price.

China HS Code Structure: HS Code Electronics

Let’s use electronics, specifically integrated circuits, as an example to explore the details of the China HS code and better understand its structure.

The HS code for integrated circuits in China is 8542321000 and it can be broken down as follows:

85: This represents the chapter, which pertains to electrical machinery and equipment, including sound recorders and reproducers, television image and sound recorders and reproducers, as well as their parts and accessories.

8542: This is the heading, indicating electronic integrated circuits.

854232: This subheading specifically refers to integrated circuits products.

8542321000: This is the CN code, which denotes multi-component integrated circuits.

Free Tools to Find the Chinese HS code

The following three tools can help you find the Chinese HS code for your goods and also the usage in different scenarios.

1. Official Website of the China Customs

The first recommendation is China custom’s official website. http://www.customs.gov.cn/customs/302427/302442/jckszcx/index.html. You can put the shipments name inside and then it will offer you the latest info of the HS codes corresponding to product names, most-favored-nation tax rates, and general tax rates, among other information.

2. YQN’s HS Code Tool

YQN’s digital logistics platform offers 9 free logistics tools and one of them is HS code searching engine.

By click this link https://www.yqn.com/logistics-tools-new/hs-code and you can just put your shipments name in English or the standard HS code, you can get the corresponding China HS code information in one second.

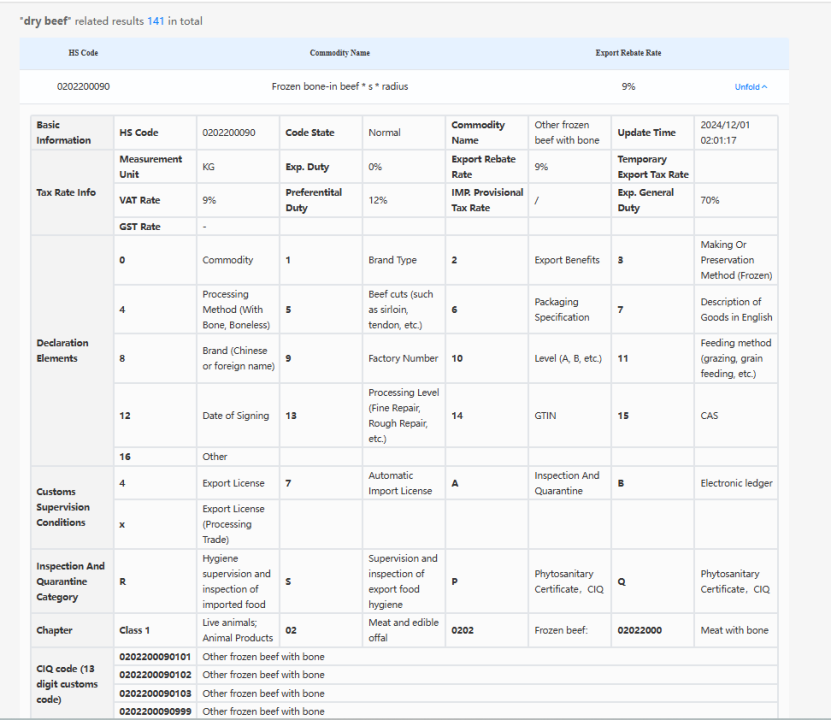

For example, if I search “dry beef”, the result will be below.

If you have any questions about usage or inquiry of China HS codes, feel free to contact us. You can reach us by sending an email to info@yqn.com, and our professionals will provide support promptly.

3. Transcutoms

The last but not the least is this website: https://www.transcustoms.com/. This website provides more data needed for importing and exporting in China, such as import tariff & tax, customs declaration, and landed cost calculator.

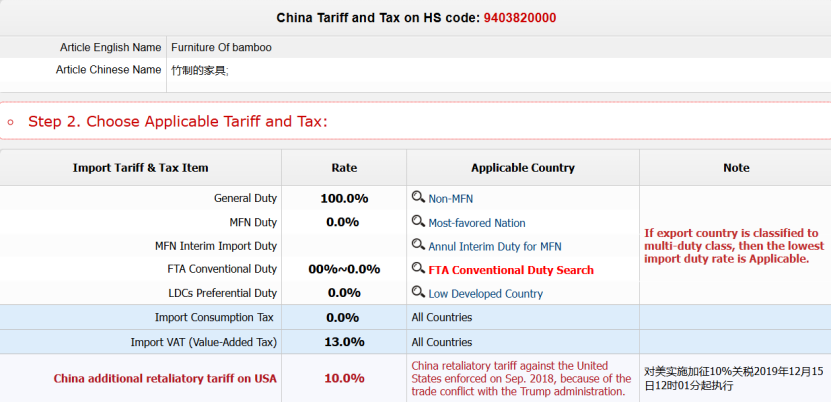

For example, if we search bamboo furniture, and below is the tariff and tax details.

Conclusion

Understanding China HS code and its usage is crucial for businesses and individuals engaged in international trade. By utilizing appropriate searching tools, you can ensure accurate product classification and facilitate smooth custom declaration or clearance.

If you have any questions regarding China HS codes or shipping from or to China, you can seek assistance from professionals in YQN via email info@yqn.com.