FAS: A Comprehensive Guide to Understanding

Sep 20, 2024

FAS (Free Alongside Ship) is an important trade term, and this article will introduce it to you in a Q&A format , including the definition of FAS, its application, comparisons with other modes of incoterms, and so on. You can also use this article to understand YQN Logistics further.

Q: What is FAS Incoterms?

A: FAS (Free Alongside Ship) is one of the Incoterms that stipulates that the seller must deliver the goods alongside the to the vessel at the named port of shipment, but is not responsible for loading the goods onto the vessel. At this point, the risk and additional costs of the goods are transferred to the buyer.

Q: What modes of transportation does FAS incoterm apply to?

A: The FAS incoterm is mainly used for transportation by waterway, especially inland waterway and sea freight. The term does not apply to air or land transportation.

Q: What are the buyer's responsibilities associated with FAS (Buyer FAS means)?

A: For transactions using FAS terms, the buyer is responsible for all costs and risks associated with the goods once they are loaded onto the vessel at the port of loading, as well as handling export clearance and all related shipping documents.

Q: Who is responsible for insurance in a FAS transaction?

A: Under FAS terms, the seller is not responsible for insurance and freight. The buyer needs to arrange his own insurance for the transportation of the goods from the port of loading to cover their risks.

Q: What are the port of loading requirements for FAS terms?

A: When using FAS, the seller must specify the port of loading in the contract and ensure that the goods are delivered to the ship within the agreed time. The seller is usually responsible for handling and storage of the goods at the port of loading until they are placed in the designated location.

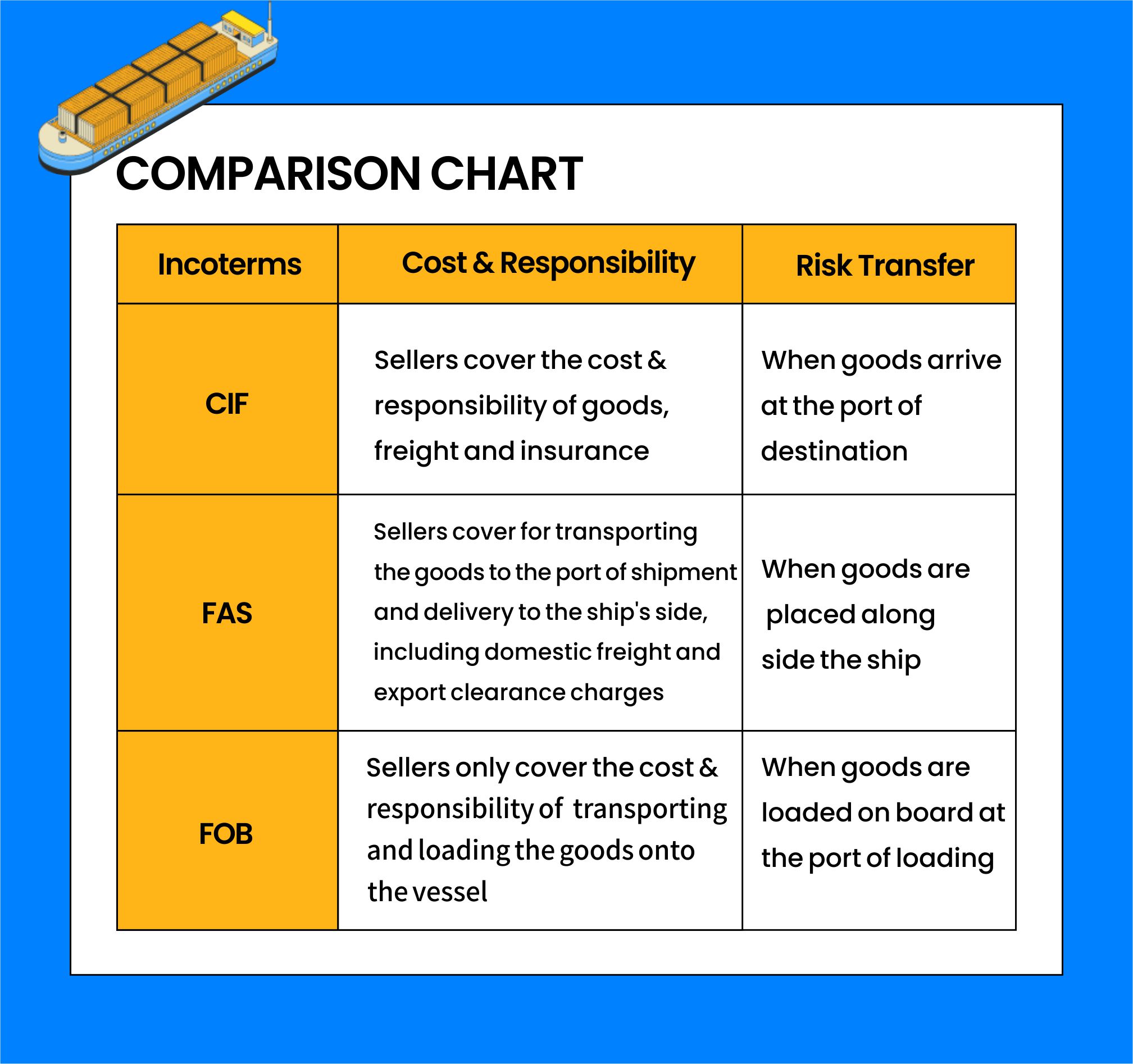

Q: What is the difference between FAS and other modes of transportation?

A:

1. FAS vs FOB

FAS: The seller is responsible for transporting the goods aloongside a ship at named port of shipment, but is not responsible for loading the goods onto the ship. The risk is transferred to the buyer when the goods arrive at the ship's side.

FOB: The seller is responsible for delivering the goods alongside the ship, but also responsible for loading the goods onto the ship, and bears all the costs and risks before loading the ship.

2. FAS vs CIF

FAS: the seller is only responsible for delivering the goods alongside the vessels at a named port of shipment, and the costs and risks after loading are borne by the buyer. The buyer has to arrange and pay for the freight and insurance from the time of loading.

CIF: The seller is responsible for freight, insurance and transportation of the goods to the port of destination.

The seller's risk ends when the goods are loaded on board the vessel, but remains responsible for freight and insurance until the goods arrive at the port of destination.

Q: What should I be aware of when using FAS clauses in practice?

A: When using FAS term, both parties should have a clear understanding of the responsibilities, costs and points of risk transfer. In addition, both parties need to ensure that all terms and responsibilities are clearly documented in the contract to avoid possible misunderstandings or disputes.

Conclusion

Enterprises should examine their trade needs and risk tolerance in detail when selecting and using FAS. The proper use of FAS terminology not only protects companies from unnecessary risk, but also optimizes cost-effectiveness through precise insurance and transportation arrangements.

If you would like to learn more about FAS (Free Alongside Ship), please contact our logistics experts at YQN Logistics. Manage your supply chain today!

-----------------------------

YQN Operation Team

info@yqn.com